At Chaffee & Associates LLC, we craft effective, tailored solutions by expertly blending tax law, estate planning, and personal finance into clear, actionable plans. Through a collaborative partnership, we simplify complex strategies and deliver top-tier family office services to guide you toward a lasting financial legacy.

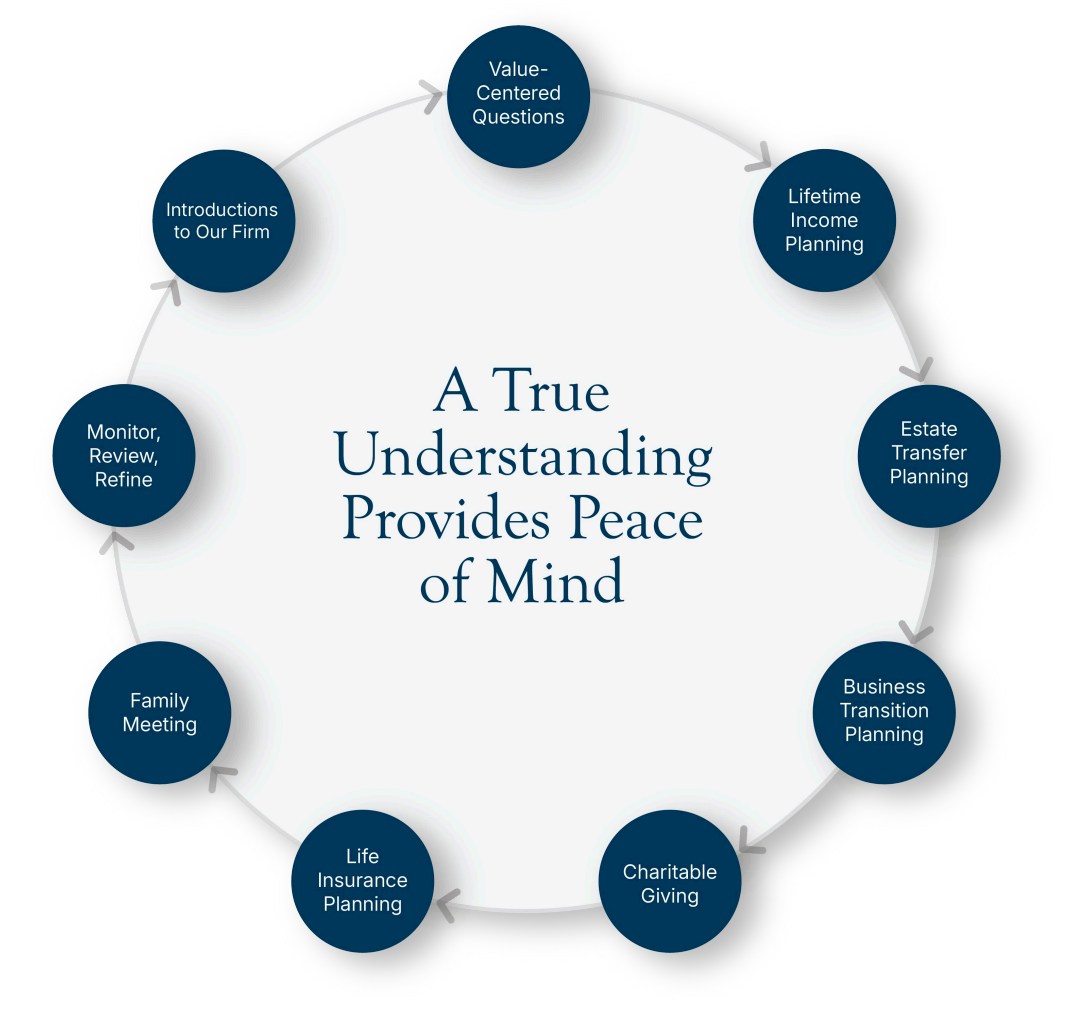

Our firm believes in a holistic approach to managing our clients financial goals. This customized process has been used as a guide to our clients for years.

The purpose of the circle is twofold. First to provide a broad overview of the services we offer. Second, to serve as a reminder that we will meet you anywhere on this circle to start the process. Then we will continue to address each aspect of your financial legacy.

In our first meeting, we want to understand what you are trying to accomplish. We do not follow a typical approach to getting to know our clients; instead we ask a series of value-centered questions that will give us a thorough understanding of your legacy goals as we create your plan.

This process is applicable to all clients; it guides families, business owners, and executive employees as they need. Read below to learn more about each aspect of our approach.

We provide this questionnaire to help us understand your goals and objectives. Your answers provide a framework as we establish and maintain your financial legacy. This acts as a compass for all your future planning.

What would it look like if something happened to you tomorrow? Is your retirement plan on par with your lifestyle? We help you to address these difficult questions by modeling your current financial situation against expected (and unexpected) life events. Our modeling helps us to pinpoint gaps and enhances your lifetime financial security. You work hard for your family and want them to be taken care of; together we will put you and your loved ones at ease.

Directed by your values and goals, we will review your current estate documents and determine whether there is alignment between what you want and what is in place. If no estate documents are currently in place, we will work with you to establish a plan and provide protection for your family.

Transitioning business ownership (whether it’s within the family, or to a third party) can create uncertainty and pressure. Our objective is to make these transitions seamless and cost effective. Our critical analysis of your transition plan and tax implications will guide you and your successor towards the best outcomes.

If you value charitable giving, we will work with you to provide creative solutions which benefit you and the causes you are passionate about, all while maintaining your personal estate plan.

Protecting your family, business, and estate is necessary. We will assess areas where you may be susceptible to risk, then provide solutions to mitigate those risks.

Discussing finances is difficult. We will facilitate family meetings to communicate your values and plans, answering any questions that your loved ones might have.

Two things can be true at once; Everyone wants their estate plan to stay updated with their life’s events, and also, life’s events can distract us from revising our estate plans. We continually seek updates about your life and will review your estate plan on an annual basis. This way, you have a partner to help you navigate your legal, financial, and personal circumstances as they change.

We thrive on client feedback; if you feel that we at Chaffee & Associates have kept our promise and kept your best interests at heart, all while providing professional and innovative guidance, we would be grateful to have your referral. Our clients’ votes of confidence are the greatest compliments.

We help wealthy clients create solutions to benefit their family.

Richard J. Chaffee, Jr.